In Maine, you need no more formal education than a high-school diploma to qualify for a real estate license. In California, you don’t even need that. I think that’s a little weird. Now, every state does require at least some special classroom training, and then a state exam. But, having sat through a fair amount of that special training myself, I’m pretty sure most fifth-graders, as well as certain minerals, could pass. It freaks me out a little. I mean, consider this ad copy for a California real estate school:

How difficult are your courses?

Our courses are not difficult to pass. The Final Exam for our courses consists of 100 multiple choice questions, and it is an Open Book Online Exam.

How difficult is the State Exam?

The State Exam is not easy, generally the state-wide pass rate hovers around 50%.

Noooo, I’m not talking about the ad hoc capitalization, or the conjoined sentences. I’m just thinking that if you’re impressed by a sales pitch that trumpets a 50% failure rate, you probably should have applied yourself a little more vigorously in fifth grade.

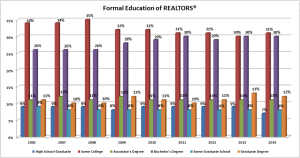

I’m just thinking that if the National Association of Realtors thought trumpeting its pretty, new graph of education levels was going to impress anyone, well…

![Honey, what's our credit score? [PD]Wikimedia](https://hvholmes.files.wordpress.com/2015/01/agostino_brunias_-_a_leeward_islands_carib_family_outside_a_hut_-_google_art_project.jpg?w=241&h=300)

![[pd] wikimedia](https://hvholmes.files.wordpress.com/2015/01/michael_maier_atalanta_fugiens_emblem_27.jpeg?w=300&h=285)